By: Sean Schmid, Chief Operating Officer – Penn Investment Advisors

Weekly Update – September 22, 2020

The Week on Wall Street

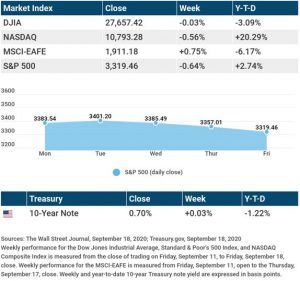

Stocks slipped as the technology sector remained under pressure and a mid-week announcement by the Federal Reserve failed to inspire investors.

The Dow Jones Industrial Average declined 0.03%, while the Standard & Poor’s 500 fell 0.64%. The Nasdaq Composite index dropped 0.56% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, rose 0.75%.[1],[2],[3]

Technology Pulls Stocks Lower

As has been the case in recent weeks, technology stocks led the market higher, then lower in an otherwise turbulent week of trading.

Merger and acquisition activity announced at the start of the week generated a rush back into technology stocks, sparking a rebound from the previous week’s drop. Stocks continued to advance until Wednesday, when investors began to digest comments from the Fed’s Federal Open Market Committee meeting. The Fed delivered a message that coupled assurances of continued low rates with concerns about the health of the economic recovery.[4]

The Fed Stays the Course

In the last Federal Open Market Committee (FOMC) meeting before the November election, the Fed signaled that interest rates would not be increased “until labor market conditions have reached levels consistent with the committee’s assessments of maximum employment and inflation has risen to 2% and is on track to moderately exceed 2% for some time.”[5]

Most Fed officials do not see this happening until 2023.

While the Fed maintained its view on the importance of fiscal stimulus to help American workers and businesses, it did improve its outlook for unemployment in its latest economic outlook. The Fed now expects unemployment would average around 7-8% in the final three months of the year, down from its June prediction of around 9-10%.[6]

THE WEEK AHEAD –

KEY ECONOMIC DATA:

Tuesday: Existing Home Sales.

Thursday: Jobless Claims. New Home Sales.

Friday: Durable Goods Orders.

Source: Econoday, September 18, 2020. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision. The release of data may be delayed without notice for a variety of reasons, including the shutdown of the government agency or change at the private institution that handles the material

THE WEEK AHEAD – COMPANIES REPORTING EARNINGS:

Tuesday: Nike (NKE), Autozone (AZO), Fedex (FDX)

Wednesday: General Mills (GIS)

Thursday: Costco Wholesale (COST), Darden Restaurants (DRI), Carnival Corp. (CCL)

Source: Zacks, September 18, 2020, Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Any investment should be consistent with your objectives, time frame and risk tolerance. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Tax Tips

Can You Benefit From the Earned Income Tax Credit?

The earned income tax credit may be able to help taxpayers put more money in their pocket. There are a few groups of people that should consider looking into the credit more. These groups may include:

- Native Americans – If a Native American taxpayer receives income as an employee or from owning a business, they may be eligible for the earned income tax credit.

- Grandparents – Grandparents who are raising grandchildren may be able to benefit from the earned income tax credit. They should make sure that the child meets the qualified child requirements. There are also a few other considerations and special rules for this segment.

- Taxpayers in Rural Areas – If you live in a rural area, you may be eligible for the credit.

The IRS has prepared the EITC Assistant to help taxpayers determine if they qualify for the EITC.

* This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov[7]

Have investment questions? Call us at 1.800.626.1027 or email us at invest@pennadvisors.com.

Share the Wealth of Knowledge!

Would someone you know benefit from receiving this communication? If so, call our office at 1.800.626.1027 to provide us with their contact information and we will be happy to send them a copy.

Footnotes, disclosures and sources:

Investment advisory services are provided through Penn Investment Advisors, Inc. (PIA), a Registered Investment Adviser. PIA is a wholly-owned subsidiary of Penn Community Bank (Bank). Investment products, securities and services offered by PIA are not a deposit of, or obligation of, or guaranteed by the Bank, or an affiliate of the Bank, are not insured by the FDIC or any agency of the United States, the Bank, or any affiliate of the bank and involve investment risk, including the possibility of loss of principal. Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Diversification does not guarantee profit nor is it guaranteed to protect assets.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Penn Investment Advisors, Inc., and other listed sources. This should not be construed as investment advice. Penn Investment Advisors, Inc., does not give tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information. By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[1] The Wall Street Journal, September 18, 2020

[2] The Wall Street Journal, September 18, 2020

[3] The Wall Street Journal, September 18, 2020

[4] The Wall Street Journal, September 16, 2020

[5] The Wall Street Journal, September 16, 2020

[6] The Wall Street Journal, September 16, 2020

[7] IRS.gov, February 3, 2020