By: Sean Schmid, Chief Operating Officer – Penn Investment Advisors

Weekly Update – January 25, 2021

Anticipation of a new fiscal stimulus and improved vaccine distribution powered stocks to fresh record highs last week with technology stocks leading the way.

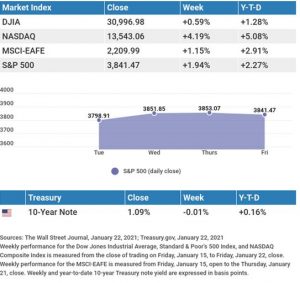

The Dow Jones Industrial Average gained 0.59%, while the Standard & Poor’s 500 picked up 1.94%. The Nasdaq Composite index led, gaining 4.19% for the week. The MSCI EAFE index, which tracks developed overseas stock markets, rose by 1.15%.1,2,3

Stocks Scale New Heights

In a holiday-shortened week, stocks rallied as investors welcomed testimony from incoming Treasury Secretary Janet Yellen to the Senate Finance Committee that suggested lawmakers needed to “act big” on fiscal stimulus, raising hopes for a new round of federal spending.

An orderly presidential transition and the anticipation of a more effective vaccine distribution plan contributed to stocks touching multiple new highs last week. Investor enthusiasm was further supported by a strong start to the fourth-quarter earnings season.

Mega-cap technology companies resumed their market leadership ahead of a full calendar of big tech earnings reports this week. Market momentum stalled a bit into the close on concerns that any stimulus spending bill might come in lower than expected.

Earnings Beating Expectations

One of the concerns of market watchers has been the valuations of stocks. Stocks are currently trading at about 23 times 2021 earnings, above the historical range of 15 to 17 times forward earnings.4

Today’s valuations may be explained by expectations of a strong economic rebound and a concomitant rise in corporate profits. So far, this earnings season appears to vindicate the optimism; With 41 of S&P 500 companies reporting through last Thursday, 91% of them have exceeded estimates by an average of 18.5%.5

Investors are expected to continue to watch company earnings in the weeks ahead to see whether these consensus-beating results continue.

This Week: Key Economic Data

Tuesday: Consumer Confidence.

Wednesday: Durable Goods Orders. FOMC (Federal Open Market Committee) Announcement.

Thursday: Gross Domestic Product (GDP). Jobless Claims. New Home Sales.

Source: Econoday, January 22, 2021

The Econoday economic calendar lists upcoming U.S. economic data releases (including key economic indicators), Federal Reserve policy meetings, and speaking engagements of Federal Reserve officials. The content is developed from sources believed to be providing accurate information. The forecasts or forward-looking statements are based on assumptions and may not materialize. The forecasts also are subject to revision.

This Week:

Companies Reporting Earnings

Monday: KimberlyClark (KMB).

Tuesday: Microsoft (MSFT), General Electric (GE), Advanced Micro Devices (AMD), Verizon (VZ), Johnson & Johnson (JNJ), Lockheed Martin (LMT), Starbucks (SBUX), 3M Company (MMM), Texas Instruments (TXN), Novartis (NVS), D.R. Horton (DHI).

Wednesday: Apple (AAPL), Facebook (FB), AT&T (T), Boeing (BA), Abbott Laboratories (ABT), ServiceNow, Inc. (NOW), General Dynamics (GD), Norfolk Southern (NSC).

Thursday: McDonalds (MCD), Comcast Corp. (CMCSA), Southwest Airlines (LUV).

Friday: Caterpillar (CAT), Chevron (CVX), Eli Lilly (LLY), Honeywell International (HON), Charter Communications (CHTR).

Source: Zacks, January 22, 2021

Companies mentioned are for informational purposes only. It should not be considered a solicitation for the purchase or sale of the securities. Investing involves risks, and investment decisions should be based on your own goals, time horizon, and tolerance for risk. The return and principal value of investments will fluctuate as market conditions change. When sold, investments may be worth more or less than their original cost. Companies may reschedule when they report earnings without notice.

Quote of the Week

“In the depth of winter, I finally learned that there was in me an invincible summer.”

– Albert Camus

Tax Tips

Know and Understand Your Correct Filing Status

Taxpayers need to know their correct filing status and be familiar with each choice.

When preparing and filing a tax return, the filing status affects:

- If the taxpayer is required to file a federal tax return

- If they should file a return in order to receive a refund

- Their standard deduction amount

- If they can claim certain credits

- The amount of tax they should pay

Here are the five filing statuses:

Single: Normally, this status is for taxpayers who are unmarried, divorced, or legally separated under a divorce or separate maintenance decree governed by the state law.

Married filing jointly: If a taxpayer is married, they can file a joint tax return with their spouse. When a spouse passes away, the widowed spouse can usually file a joint return for that year.

Married filing separately: Married couples can choose to file separate tax returns, when doing so results in less tax owed than filing a joint tax return.

Head of household: Unmarried taxpayers may be able to file using this status, but special rules apply. For example, the taxpayer must have paid more than half the cost of keeping up a home for themself and a qualifying person living in the home for half of the year.

Qualifying widow(er) with dependent child: This status may apply to a taxpayer if their spouse died during one of the previous two years and they have a dependent child. Other conditions also apply.

* This information is not intended to be a substitute for specific individualized tax advice. We suggest that you discuss your specific tax issues with a qualified tax professional.

Tip adapted from IRS.gov6

Have investment questions? Call us at 1.800.626.1027 or email us at invest@pennadvisors.com.

Share the Wealth of Knowledge!

Would someone you know benefit from receiving this communication? If so, call our office at 1.800.626.1027 to provide us with their contact information and we will be happy to send them a copy.

Footnotes, disclosures and sources:

Investment advisory services are provided through Penn Investment Advisors, Inc. (PIA), a Registered Investment Adviser. PIA is a wholly-owned subsidiary of Penn Community Bank (Bank). Investment products, securities and services offered by PIA are not a deposit of, or obligation of, or guaranteed by the Bank, or an affiliate of the Bank, are not insured by the FDIC or any agency of the United States, the Bank, or any affiliate of the bank and involve investment risk, including the possibility of loss of principal. Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values. Diversification does not guarantee profit nor is it guaranteed to protect assets.

International investing involves special risks such as currency fluctuation and political instability and may not be suitable for all investors.

The Standard & Poor’s 500 (S&P 500) is an unmanaged group of securities considered to be representative of the stock market in general.

The Dow Jones Industrial Average is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange and the NASDAQ. The DJIA was invented by Charles Dow back in 1896.

The Nasdaq Composite is an index of the common stocks and similar securities listed on the NASDAQ stock market and is considered a broad indicator of the performance of stocks of technology companies and growth companies.

The MSCI EAFE Index was created by Morgan Stanley Capital International (MSCI) that serves as a benchmark of the performance in major international equity markets as represented by 21 major MSCI indexes from Europe, Australia and Southeast Asia.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Investing involves risk including the potential loss of principal. No investment strategy can guarantee a profit or protect against loss in periods of declining values.

Opinions expressed are subject to change without notice and are not intended as investment advice or to predict future performance.

Past performance does not guarantee future results.

You cannot invest directly in an index.

Consult your financial professional before making any investment decision.

Fixed income investments are subject to various risks including changes in interest rates, credit quality, inflation risk, market valuations, prepayments, corporate events, tax ramifications and other factors.

These are the views of Penn Investment Advisors, Inc., and other listed sources. This should not be construed as investment advice. Penn Investment Advisors, Inc., does not give tax or legal advice. All information is believed to be from reliable sources; however, we make no representation as to its completeness or accuracy. Please consult your financial advisor for further information. By clicking on these links, you will leave our server, as they are located on another server. We have not independently verified the information available through this link. The link is provided to you as a matter of interest. Please click on the links below to leave and proceed to the selected site.

[2] The Wall Street Journal, January 22, 2021

[3] The Wall Street Journal, January 22, 2021

[4] CNBC, January 21, 2021

[5] Earnings Scout, January 21, 2021

[6] IRS.gov, October 1, 2020